Shigeru Ishiba’s resignation could significantly impact the Japanese economy, creating uncertainty in markets and investor confidence. As new leadership emerges, fluctuations in stock prices and the yen are likely, affecting both domestic and international investments. Businesses must adapt to these changes by staying informed and adjusting strategies to navigate the evolving economic landscape.

Shigeru Ishiba’s resignation as Prime Minister can shake up the Japanese economy. His policies aimed to boost growth, so his exit could cause uncertainty. Investors may think twice before committing their money.

Market Reactions to Leadership Changes

Markets often respond quickly to changes in leadership. Traders watch for signs that could impact the economy. With Ishiba gone, stock prices might fluctuate as people figure out what comes next.

Currency Fluctuations

The yen may see a lot of action after Ishiba resigns. Currency traders often bet on new leadership. This can lead to the yen getting stronger or weaker depending on how people feel about Japan’s future.

Investor Confidence

Confidence is key for any economy. Ishiba’s leadership style attracted some investors, who are now left wondering. They may pause their investments as they wait to see who will take over and what changes will follow.

Long-Term Effects

In the long run, Ishiba’s resignation could affect Japan’s economic plans. He had the support to push through reforms. New leaders may not maintain the same focus, slowing progress on important issues.

Japan’s economy faces a lot of change right now. As political dynamics shift, businesses and consumers will need to stay alert and prepared for new challenges. Keeping an eye on these developments will be vital for everyone in the market.

Conclusion

In conclusion, Shigeru Ishiba’s resignation could bring big changes for the Japanese economy. As markets react to this shift, both investors and consumers will feel the impact. Businesses must stay alert to adapt to these new conditions and keep moving forward.

Uncertainty in leadership can lead to shifts in investor confidence and currency value. Therefore, understanding these dynamics is crucial for anyone involved in Japan’s financial landscape. The future might seem unclear now, but staying informed and prepared will help everyone navigate the economic waters ahead.

FAQ – Frequently Asked Questions about the Economic Impact of Ishiba’s Resignation

What does Ishiba’s resignation mean for the Japanese economy?

Ishiba’s resignation may lead to uncertainty in the economy, affecting market confidence and possibly impacting investments.

How might the stock market react to this leadership change?

Markets often react quickly to political changes. Stocks may fluctuate as investors reassess the situation under new leadership.

What impact could this have on the yen?

The yen might strengthen or weaken based on investor sentiment toward Japan’s economic future following Ishiba’s departure.

How can businesses prepare for changes in leadership?

Businesses should stay informed about political developments and assess their strategies to adapt to potential market shifts.

Why is investor confidence important after a resignation?

Investor confidence is crucial as it drives economic stability. A lack of confidence can halt investments and slow economic growth.

What long-term effects might arise from this resignation?

Long-term, Ishiba’s absence could slow necessary reforms in Japan, affecting growth and development strategies across various sectors.

Miran Highlights Dual Goals of Fed and Interest Rate Outlook

Miran Highlights Dual Goals of Fed and Interest Rate Outlook  Are You a Robot? Unusual Activity Detected on Bloomberg

Are You a Robot? Unusual Activity Detected on Bloomberg  Keir Starmer Leads Business Delegation to India for Trade Pact

Keir Starmer Leads Business Delegation to India for Trade Pact  Takaichi Appoints Ex-Finance Minister as Secretary General of LDP

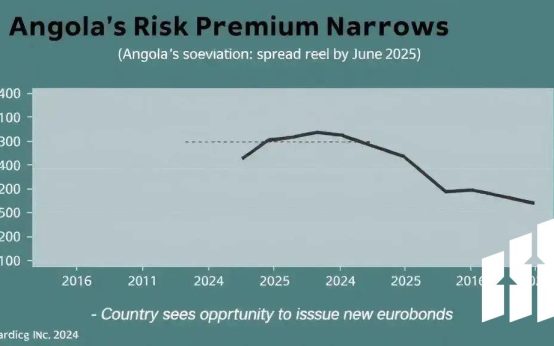

Takaichi Appoints Ex-Finance Minister as Secretary General of LDP  Argentina Continues Dollar Sales Amid Weakened Peso Crisis

Argentina Continues Dollar Sales Amid Weakened Peso Crisis  White House Calls on Democrats to Resolve Ongoing Government Shutdown

White House Calls on Democrats to Resolve Ongoing Government Shutdown