The European Central Bank (ECB) expresses a cautious stance on interest rates, indicating no immediate changes while closely monitoring inflation and economic indicators. Stability in interest rates is vital for businesses and consumers as it facilitates planning and mitigates uncertainty. The ECB’s careful approach aims to support economic growth while ensuring inflation remains under control, making it important for individuals to stay informed about these policies to make sound financial decisions.

The European Central Bank (ECB) plays a key role in shaping interest rates across Europe. Recently, ECB officials have shared their views about the current rates and the outlook on inflation.

Current Interest Rates

As it stands, interest rates are stable. ECB leaders emphasize caution and careful analysis of economic data before making any changes. This steady approach aims to provide clear guidance to markets and consumers.

Inflation Outlook

Inflation continues to be a hot topic. Officials are monitoring prices closely. Their goal is to keep inflation in check without rushing to change rates. By doing so, they hope to support economic growth.

Why Stability Matters

Stability in interest rates helps businesses and families plan for the future. When rates change frequently, it creates uncertainty. ECB’s steady approach signals confidence in the economy’s recovery.

What to Expect Next

The ECB will keep a close watch on economic indicators. This includes inflation, growth, and unemployment rates. The next steps will depend on these factors. As data emerges, we can expect more guidance from the ECB.

Understanding ECB’s perspective is crucial for everyone. Whether you’re a business owner or a homeowner, these policies affect your financial decisions. Staying informed can help you navigate these changes better.

Conclusion

In conclusion, understanding the ECB’s views on interest rates and inflation is vital for everyone involved in the economy. Their stable approach helps create a predictable environment for businesses and consumers alike. Monitoring inflation and economic indicators closely ensures that the ECB can act when necessary.

As we look to the future, staying informed about these policies will empower you to make better financial decisions. Whether you’re planning for a big investment or simply managing your budget, knowledge is key. The ECB’s actions today will shape the economic landscape tomorrow, and staying tuned to their strategies is crucial for navigating these changes effectively.

FAQ – Frequently Asked Questions about ECB’s Interest Rates and Inflation Outlook

What is the current stance of the ECB on interest rates?

The ECB maintains a stable stance on interest rates, showing caution and careful analysis before any changes.

Why is the ECB monitoring inflation closely?

The ECB is monitoring inflation to ensure it remains in check while supporting economic growth.

How does stable interest rates benefit businesses?

Stable interest rates provide predictability, allowing businesses to plan their finances and investments without uncertainty.

What factors influence the ECB’s decisions on interest rates?

The ECB considers economic indicators such as inflation, growth, and unemployment rates when deciding on interest rates.

How can individuals stay informed about ECB policies?

Keeping an eye on official ECB announcements and economic news can help individuals stay up-to-date with their policies.

What should consumers do with the current interest rate environment?

Consumers should assess their financial plans, as stable interest rates might be a good time for investments or borrowing.

Miran Highlights Dual Goals of Fed and Interest Rate Outlook

Miran Highlights Dual Goals of Fed and Interest Rate Outlook  Are You a Robot? Unusual Activity Detected on Bloomberg

Are You a Robot? Unusual Activity Detected on Bloomberg  Keir Starmer Leads Business Delegation to India for Trade Pact

Keir Starmer Leads Business Delegation to India for Trade Pact  Takaichi Appoints Ex-Finance Minister as Secretary General of LDP

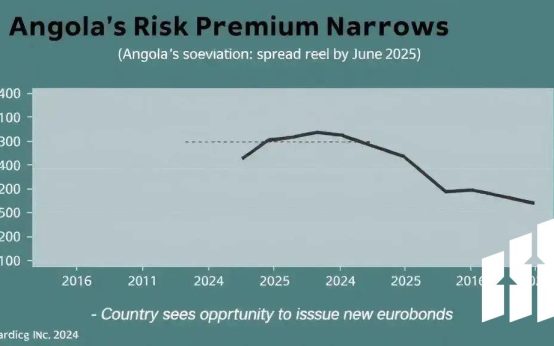

Takaichi Appoints Ex-Finance Minister as Secretary General of LDP  Argentina Continues Dollar Sales Amid Weakened Peso Crisis

Argentina Continues Dollar Sales Amid Weakened Peso Crisis  White House Calls on Democrats to Resolve Ongoing Government Shutdown

White House Calls on Democrats to Resolve Ongoing Government Shutdown