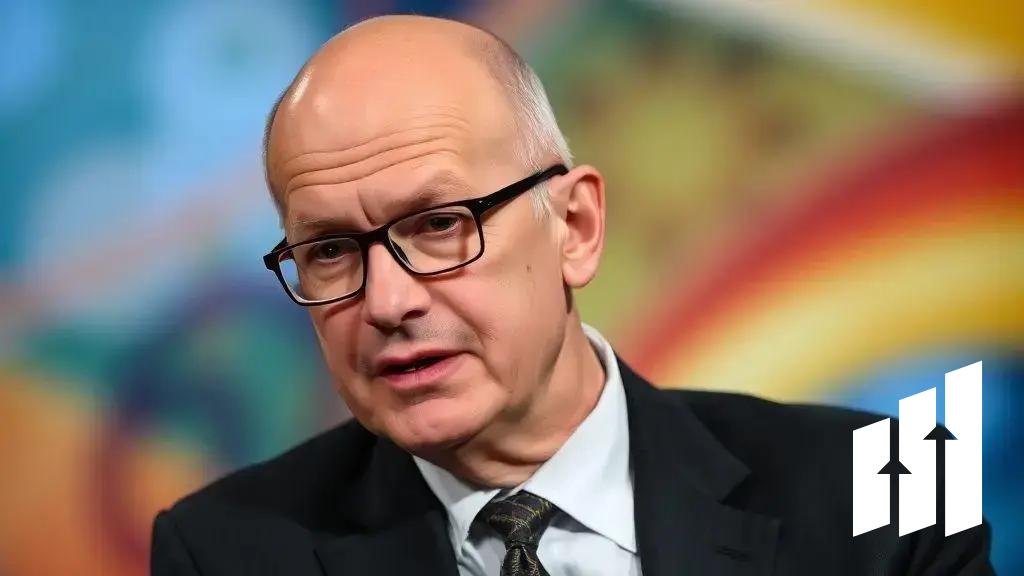

Federal Reserve Governor Stephen Miran emphasizes the importance of balancing job growth and controlling inflation. His perspective highlights that the Fed aims to achieve both objectives without compromising either. By focusing on maximum employment and stable prices, the Fed can foster stronger economic growth. Miran’s approach suggests that flexible policies can adapt to changing economic conditions, ultimately benefiting the overall economy.

Governor Stephen Miran of the Federal Reserve offers an interesting take on the bank’s goals. He believes that the Fed can balance its targets for job growth and controlling inflation. This idea may seem surprising to some, but Miran has confidence in this dual approach.

The Importance of Employment

For Miran, creating jobs is a top priority. A strong job market benefits everyone. When more people are employed, they can spend more money, which helps the economy grow. Miran explains that healthy employment rates lead to a stable financial system.

Managing Inflation Concerns

Inflation can be tricky for the economy. It means prices are rising, which can hurt consumers. Miran emphasizes that the Fed’s job is to keep inflation in check. If inflation gets too high, it can lead to problems, making goods and services less affordable.

Finding Balance

Miran advocates for a careful balance between these two goals. He argues that the Fed should not sacrifice job growth just to control inflation. Instead, he believes they can achieve both by making smart policy decisions.

This perspective encourages many to feel cautious yet optimistic about the future. By focusing on both objectives, the Federal Reserve can create a more robust economy.

Future Policies

Looking ahead, Miran suggests that policies need to adapt to changing economic conditions. The Fed’s approach should be flexible. This means they have to listen to the economy and respond appropriately.

Conclusion

In conclusion, Governor Stephen Miran’s perspective on the Federal Reserve’s dual goals shows promising potential. Balancing job growth with inflation control is vital for a healthy economy. By managing both objectives wisely, the Fed can create a stable environment that benefits everyone.

This balanced approach gives hope for a brighter economic future. Policymakers need to stay flexible, adapting to changes and responding to what the economy needs. Ultimately, listening to economic signals can help in achieving lasting prosperity for all sectors.

FAQ – Frequently Asked Questions about the Federal Reserve’s Goals and Policies

What are the dual goals of the Federal Reserve?

The dual goals of the Federal Reserve are to promote maximum employment and to maintain stable prices, including controlling inflation.

How does job growth benefit the economy?

Job growth increases consumer spending, which boosts demand for goods and services, leading to overall economic growth.

What is inflation, and why is it a concern?

Inflation refers to the rise in prices. High inflation can reduce purchasing power, making it difficult for consumers to afford essential goods.

How does the Federal Reserve manage inflation?

The Federal Reserve manages inflation by adjusting interest rates and implementing monetary policies to control money supply in the economy.

Why is it important for the Fed to balance its objectives?

Balancing its objectives ensures that the Fed can support a healthy job market without letting inflation get out of control.

What role does flexibility play in Federal Reserve policies?

Flexibility allows the Federal Reserve to adapt its policies to changing economic conditions, ensuring effective responses to emerging challenges.

Are You a Robot? Unusual Activity Detected on Bloomberg

Are You a Robot? Unusual Activity Detected on Bloomberg  Keir Starmer Leads Business Delegation to India for Trade Pact

Keir Starmer Leads Business Delegation to India for Trade Pact  Takaichi Appoints Ex-Finance Minister as Secretary General of LDP

Takaichi Appoints Ex-Finance Minister as Secretary General of LDP  Argentina Continues Dollar Sales Amid Weakened Peso Crisis

Argentina Continues Dollar Sales Amid Weakened Peso Crisis  White House Calls on Democrats to Resolve Ongoing Government Shutdown

White House Calls on Democrats to Resolve Ongoing Government Shutdown  White House Intensifies Pressure on Democrats Amid Ongoing Government Shutdown

White House Intensifies Pressure on Democrats Amid Ongoing Government Shutdown