The Bank of Canada has recently lowered interest rates to 2.25% in response to slower economic growth. This decision aims to encourage borrowing and spending, benefiting both consumers and businesses. Lower interest rates can lead to cheaper loans, making home purchases and investments more accessible. As a result, this move may boost confidence in the economy and stimulate growth moving forward.

The Bank of Canada recently decided to cut interest rates. This move drops the rate to 2.25%. The bank aims to support the economy during uncertain times. Lower interest rates can make loans cheaper. This means businesses and families may find it easier to borrow money.

Why Did the Bank Cut Rates?

The decision came as the economy faced some challenges. Slower growth can be a worry for everyone. Lower rates are one way to help boost spending. When rates are lower, people might choose to spend more money.

Impact on Consumers

What does this mean for consumers? With lower rates, mortgages and personal loans become less expensive. This can be good news for people looking to buy homes or make big purchases. It might encourage you to take that trip or invest in a new car.

Reactions from Investors

Investors often react strongly to rate changes. Lower rates can lead to more investment in businesses. Stocks might rise, benefiting those who own them. However, some investors could worry about the health of the economy.

Looking Forward

The Bank of Canada will keep an eye on economic conditions. Adjusting interest rates is just part of their strategy. They want to ensure growth continues in a positive direction. Overall, cutting rates may help boost confidence in spending and investments.

Conclusion

In conclusion, the Bank of Canada’s decision to cut interest rates offers a chance for growth. Lower rates can help households and businesses feel more confident. When borrowing becomes cheaper, people may spend more and invest in their future.

This move shows that the bank is paying attention to the economy. It aims to support shoppers and investors alike. Overall, these changes can positively impact many lives. Keeping an eye on the economy will help ensure success moving forward.

FAQ – Frequently Asked Questions about Bank of Canada’s Interest Rate Cuts

Why did the Bank of Canada cut interest rates?

The Bank of Canada cut interest rates to support the economy in light of slower growth and economic challenges.

How will the interest rate cut affect consumers?

With lower interest rates, loans and mortgages become cheaper, making it easier for consumers to borrow money for purchases.

What is the impact of lower interest rates on businesses?

Lower interest rates can encourage businesses to invest and expand, as borrowing costs are reduced, allowing for growth and development.

How do investors react to interest rate changes?

Investors often react to interest rate changes by adjusting their investments, as lower rates can lead to higher stock prices and more investment opportunities.

Will the Bank of Canada change rates again in the future?

The Bank of Canada monitors economic conditions closely and may adjust rates again based on future economic performance.

What should consumers do in response to the interest rate cut?

Consumers should consider taking advantage of lower rates by refinancing loans or making new purchases, as this may save them money over time.

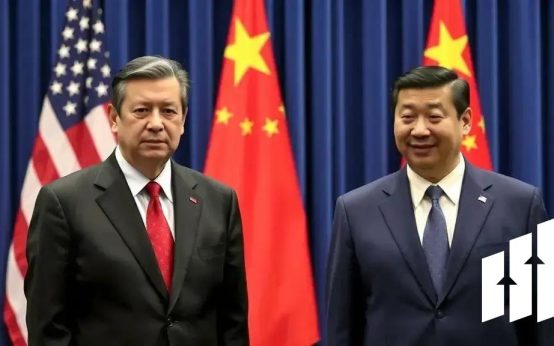

Trump and Xi Jinping Begin Critical Trade Discussions in South Korea

Trump and Xi Jinping Begin Critical Trade Discussions in South Korea  Powell’s Warning: Fed’s Divided Stance on December Interest Rates

Powell’s Warning: Fed’s Divided Stance on December Interest Rates  Argentina Peso Poised for Growth After Elections and Debt Sales Rush

Argentina Peso Poised for Growth After Elections and Debt Sales Rush  Federal Reserve Expected to Cut Rates at Upcoming Meeting

Federal Reserve Expected to Cut Rates at Upcoming Meeting  Federal Reserve Poised to Cut Interest Rates Amid Economic Uncertainty

Federal Reserve Poised to Cut Interest Rates Amid Economic Uncertainty  ADP Launches Weekly Payroll Reports to Revamp Labor Market Insights

ADP Launches Weekly Payroll Reports to Revamp Labor Market Insights