The central bank’s decision to cut interest rates to 7.50% in Mexico can significantly influence economic growth. Lower rates encourage borrowing, which leads to increased consumer spending and business investments. While this can stimulate the economy and create jobs, there are potential risks such as excessive debt. It’s crucial for policymakers to balance promoting growth with the need for financial stability to ensure sustainable economic progress.

When the central bank cuts interest rates, it can have a big impact on economic growth in Mexico. Lower rates mean that borrowing money becomes cheaper, which encourages businesses to take out loans. This growth in borrowing can lead to more investment, allowing companies to expand.

How Lower Rates Affect Spending

With lower interest rates, consumers are more likely to spend. When loans for cars or homes cost less, people feel more confident to make big purchases. This spending boosts the economy, creating jobs and increasing demand for goods and services.

Investment Incentives

Businesses also respond to lower rates. Cheaper loans mean that firms can invest in new equipment or projects. This investment often leads to job creation, which helps the economy grow even more.

Real Estate Market Effects

The real estate market can see a significant boost from interest rate cuts. Lower mortgage rates often lead to more home sales. This increase in housing activity can have a positive ripple effect on related markets, like construction and home improvement.

Possible Downsides

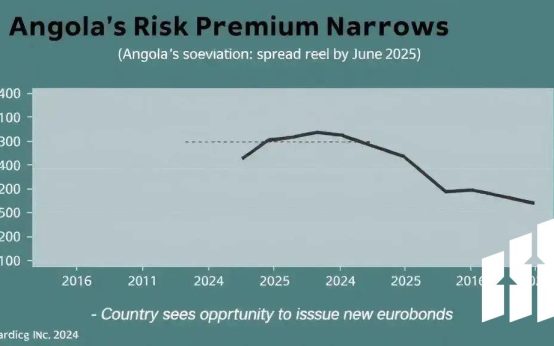

However, there can be downsides too. If rates stay low for too long, it may encourage risky financial behavior. People and businesses might take on more debt than they can handle.

Overall, while cutting interest rates can drive economic growth in Mexico, it’s important to balance this with caution. The goal is to support sustainable growth without creating financial instability.

Conclusion

In conclusion, cutting interest rates can significantly influence economic growth in Mexico. Lower rates encourage both consumers and businesses to spend and invest, which can lead to more jobs and a stronger economy. However, it is essential to proceed with caution. While stimulating growth, it’s crucial to avoid excessive debt and financial risks.

Balancing these factors is vital for sustainable economic progress. Overall, a careful approach to interest rate management can help foster a thriving economic environment that benefits everyone in Mexico.

FAQ – Frequently Asked Questions about Interest Rate Cuts in Mexico

How do interest rate cuts impact consumer spending?

Interest rate cuts make borrowing cheaper, encouraging consumers to take loans for big purchases like cars and homes, which boosts spending.

What is the effect of lower interest rates on business investment?

Lower interest rates prompt businesses to borrow more for investments, leading to expansion and often resulting in job creation.

Can interest rate cuts affect the real estate market?

Yes, lower mortgage rates generally lead to increased home sales and greater activity in related markets like construction.

What are the potential downsides of prolonged low interest rates?

Prolonged low rates can encourage excessive borrowing, leading to financial risks and potential instability in the economy.

How do interest rate cuts contribute to economic growth?

By encouraging both consumer spending and business investment, interest rate cuts can help stimulate economic growth and create jobs.

Miran Highlights Dual Goals of Fed and Interest Rate Outlook

Miran Highlights Dual Goals of Fed and Interest Rate Outlook  Are You a Robot? Unusual Activity Detected on Bloomberg

Are You a Robot? Unusual Activity Detected on Bloomberg  Keir Starmer Leads Business Delegation to India for Trade Pact

Keir Starmer Leads Business Delegation to India for Trade Pact  Takaichi Appoints Ex-Finance Minister as Secretary General of LDP

Takaichi Appoints Ex-Finance Minister as Secretary General of LDP  Argentina Continues Dollar Sales Amid Weakened Peso Crisis

Argentina Continues Dollar Sales Amid Weakened Peso Crisis  White House Calls on Democrats to Resolve Ongoing Government Shutdown

White House Calls on Democrats to Resolve Ongoing Government Shutdown