Understanding risk vs. return in investments means recognizing that higher potential returns come with higher risks, and balancing your portfolio through diversification and aligning choices with your risk tolerance and financial goals reduces investment uncertainty.

Understanding risk vs. return in investments isn’t just for financial pros—it’s something all of us bump into when putting money to work. Ever wondered why some investments feel safer yet offer smaller rewards, while others promise big wins but keep you awake at night? Let’s unpack what this tension means for you.

Defining risk and return in investment terms

In investing, risk refers to the chance that your investment’s actual returns will differ from what you expect, potentially leading to losses. Meanwhile, return is the profit or income generated by an investment over time. These two elements are naturally linked—generally, the higher the potential return, the greater the risk involved.

Risk can come from various sources such as market fluctuations, economic changes, or company performance. For example, stocks typically carry more risk than bonds because their prices can be more volatile. Returns can be realized through capital gains, dividends, or interest payments depending on the investment type.

Types of Investment Risk

Understanding different types of risk is crucial. Market risk is the risk of losses due to overall market movements. Credit risk involves the possibility that a borrower may not repay a loan. There’s also liquidity risk, where you might not be able to sell your investment quickly without affecting its price.

Recognizing these distinctions helps investors make informed decisions that match their goals and comfort with uncertainty. Balancing risk and return is key to building a resilient investment portfolio.

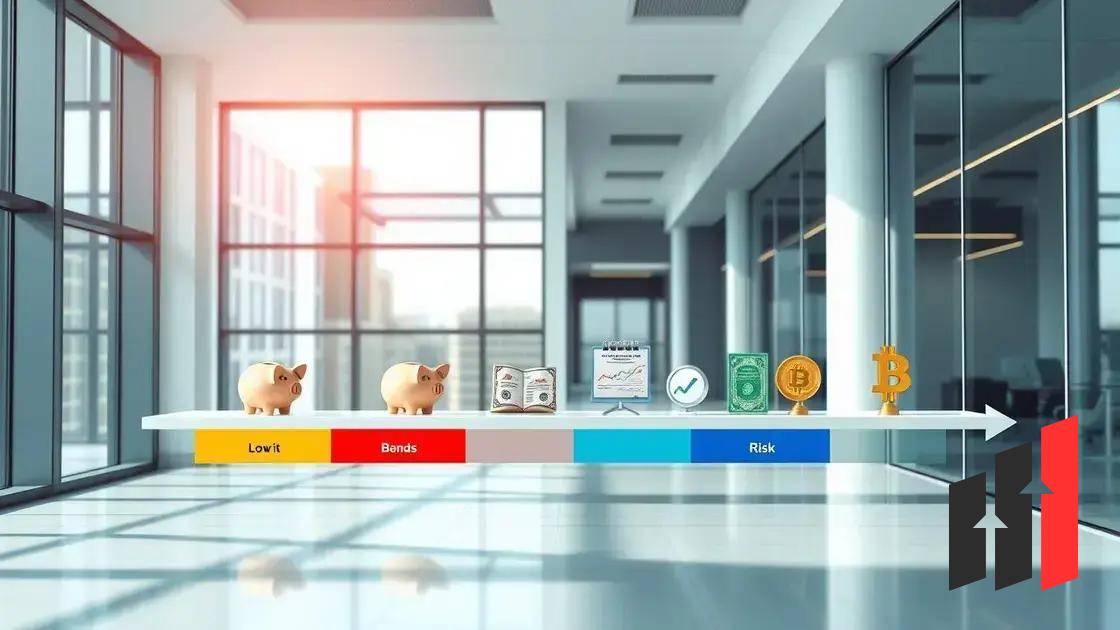

How different investments rank on the risk-return spectrum

Investments fall on a risk-return spectrum where each option offers a different balance of potential rewards and uncertainties. For instance, savings accounts and government bonds are on the low-risk end, providing steady but generally lower returns. On the opposite end, stocks and cryptocurrencies can offer higher returns but come with increased volatility and risk of loss.

Low-risk investments

These include cash equivalents and government bonds. They are considered safer because they have a low chance of losing value. However, their returns tend to be modest, often just enough to keep up with inflation.

Moderate-risk investments

Examples are corporate bonds and balanced mutual funds. They carry more risk than government bonds but usually offer better returns. These investments aim to balance growth and stability.

High-risk investments

Stocks, commodities, and cryptocurrencies fit in this category. While the potential for high returns exists, they are highly volatile. Investors must be prepared for significant price swings and possible losses.

Understanding where investments lie on this spectrum helps you build a portfolio that aligns with your financial goals and comfort with risk. Diversifying across different risk levels can also improve your chances of steady growth.

The role of diversification in managing investment risk

Diversification means spreading your investments across different assets to reduce risk. Instead of putting all your money into one stock or sector, you invest in a mix of stocks, bonds, and other assets. This strategy helps balance the risk and return by protecting your portfolio from big losses.

Why diversification matters

If one investment performs poorly, others in your portfolio might do well, which can offset losses. For example, while the stock market can be volatile, bonds often provide steady income and less risk.

Types of diversification

You can diversify by asset class (stocks, bonds, cash), geography (domestic and international markets), and sectors (technology, healthcare, consumer goods). This helps protect you against local economic downturns or industry-specific issues.

Building a diversified portfolio

Start by assessing your risk tolerance and goals. Then, choose a mix of investments that align with them. Many investors use mutual funds or exchange-traded funds (ETFs) to easily gain broad exposure to different assets.

Diversification is not a guarantee against loss but is a powerful tool to manage risk and pursue stable returns over time.

Understanding your risk tolerance and investment goals

Risk tolerance is the level of uncertainty you are comfortable with when investing. It varies from person to person based on financial situation, age, and personal preferences. Knowing your risk tolerance helps you pick investments that match your comfort with ups and downs.

Assessing your risk tolerance

Ask yourself: How would I feel if my investment lost 10% in a short time? Would I panic or stay calm? Tools like risk questionnaires can help identify your risk level, ranging from conservative to aggressive.

Setting clear investment goals

Determine what you want to achieve with your investments. Are you saving for retirement, a home, or education? Different goals may require different time frames and risk approaches. For example, long-term goals often allow more risk for higher returns.

Aligning goals with risk

Match your portfolio to both your goals and risk tolerance. A balanced approach means taking enough risk to meet your goals but not so much that you lose sleep. Regular reviews help you adjust as life changes.

Understanding these two factors is essential for creating an investment strategy that feels right and works for your future.

Common mistakes when assessing risk and return

Many investors make common mistakes when assessing risk and return that can hurt their financial plans. One frequent error is focusing only on potential returns without fully considering the risks involved. This can lead to taking on more risk than intended.

Ignoring risk tolerance

Some investors fail to assess their own comfort with risk properly. Taking on investments that are too volatile for your personality or situation can cause stress and rash decisions.

Overlooking diversification

Putting all money into similar investments increases risk. Neglecting to diversify your portfolio can amplify losses during market downturns.

Chasing past performance

Another mistake is assuming past high returns will continue. Markets change, and what worked before might not work in the future.

Not considering time horizon

Choosing investments without matching them to your time frame can be harmful. Short-term goals need safer investments, while long-term goals can often tolerate more risk.

Avoiding these mistakes by understanding both risk and return leads to smarter investing and better peace of mind.

Understanding risk and return is key to smart investing

Knowing how risk and return work together helps you make better investment choices that fit your goals and comfort level.

Avoiding common mistakes like ignoring your risk tolerance or chasing past performance can protect your savings and reduce stress.

By diversifying and aligning your investments with your personal situation, you can build a balanced portfolio that helps you grow your wealth over time.

Keep learning and reviewing your investments to stay on track and make confident decisions for your financial future.

FAQ – Understanding risk and return in investments

What is the relationship between risk and return in investments?

Risk and return are linked; generally, higher potential returns come with higher risks, meaning you could earn more but also lose more.

How can I assess my risk tolerance?

You can assess your risk tolerance by considering how comfortable you are with losing money and using risk questionnaires to find your personal level.

Why is diversification important in investing?

Diversification reduces risk by spreading investments across different assets, which helps balance potential losses and gains.

What are common mistakes to avoid when assessing risk and return?

Common mistakes include ignoring your risk tolerance, chasing past performance, not diversifying, and mismatching investments with your time horizon.

How do investment goals affect risk choices?

Your goals influence the risk you can take; short-term goals usually require safer investments, while long-term goals can tolerate more risk for higher returns.

Can risk tolerance change over time?

Yes, your risk tolerance can change with your financial situation, age, and life events, so it’s important to review your investments regularly.

Miran Highlights Dual Goals of Fed and Interest Rate Outlook

Miran Highlights Dual Goals of Fed and Interest Rate Outlook  Are You a Robot? Unusual Activity Detected on Bloomberg

Are You a Robot? Unusual Activity Detected on Bloomberg  Keir Starmer Leads Business Delegation to India for Trade Pact

Keir Starmer Leads Business Delegation to India for Trade Pact  Takaichi Appoints Ex-Finance Minister as Secretary General of LDP

Takaichi Appoints Ex-Finance Minister as Secretary General of LDP  Argentina Continues Dollar Sales Amid Weakened Peso Crisis

Argentina Continues Dollar Sales Amid Weakened Peso Crisis  White House Calls on Democrats to Resolve Ongoing Government Shutdown

White House Calls on Democrats to Resolve Ongoing Government Shutdown